MAN CHARGED WITH $7MILLION PONZI SCHEME DROWNS BEFORE HIS TRIAL

A Canadian man accused of running a $7.8 million Ponzi scheme has drowned in a British Columbia river seven months before his trial was set to kick off in Edmonton.

Curtis Quigley, 56, and his former common-law spouse Kathleen Treadgold were officially charged last August with 80 counts of fraud over $5,000.

Edmonton Police alleged the couple ran the scam for 12 years, duping hundreds of Canadian, American and Australian investors. Some of them claimed Quiqley, thought of as the mastermind, owed them over $1 million, CBC originally reported.

With Quiqley now dead after drowning in the Okanagan River on June 20, experts say the charges against him filed by the Alberta Crown Prosecution Service (ACPS) will eventually be dropped.

The charges against Treadgold remain active, CBC reports, though it's unclear how Quiqley's mysterious death will have on her case.

'As with all files, the ACPS assesses on an ongoing basis whether there is a reasonable likelihood of conviction and if the matter is in the public interest,' ACPS spokesperson Michelle Davio said.

As the British Columbia Coroners Service continues investigating Quigley's death, prosecutors are awaiting a death certificate to officially stay his fraud trial, which would have started in 2025.

Authorities say two witnesses told them Quiqley, who was out on bail, was walking two dogs along a trail by the river he would ultimately drown in.

The dogs then reportedly saw a deer and jumped into the water to chase it, with the witnesses saying Quiqley went in after them.

Tony Iannella, chief of the nearby Willowbrook Volunteer Fire Department, responded to the call along with the Okanagan Falls Volunteer Fire Department.

But by the time Iannella arrived, it was already too late.

One of the witnesses had already yanked Quiqley from the water, after which Okanagan Falls firefighters performed CPR.

Paramedics arrived shortly after and said he couldn't be revived.

Quiqley used to live with Treadgold in Kelowna, which is about 37 miles from where he drowned.

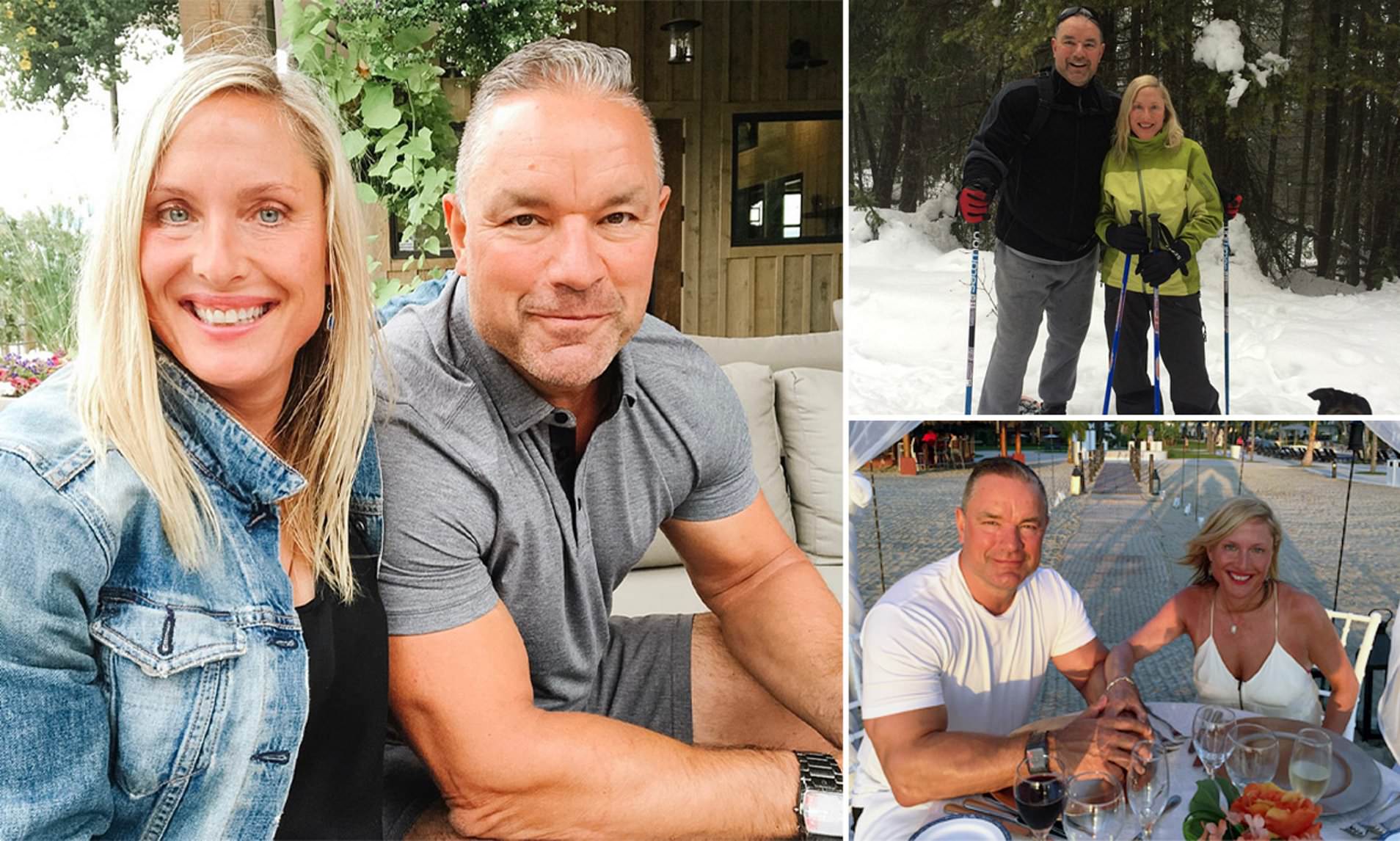

Throughout their years together, the couple was known to have gone on trips to beaches, a ski center in Canada and a romantic getaway to a resort in Mexico.

Activity like this normally wouldn't raise any alarm, but civil court records from 2020 show that Quiqley was allegedly using investor funds not to buy and flip houses as he claimed, but to pay previous investors off.

This is one of the hallmarks of a Ponzi scheme.

The person running the fraud will tell the individuals investing with him that he's putting their money into legitimate investments such as real estate or stocks, when in actuality, he's using the new investors' money to pay older investors.

This gives investors the illusion they are making money, when really, they're just getting other people's money. Schemes like this are unsustainable, eventually collapsing when there are no more new investors to bring in.

A woman who invested with him sought a bankruptcy order against him in 2020, claiming he owed her $1.6 million. Three other creditors filed affidavits claiming Quigley also owed them 'substantial' sums of money.

Once the bankruptcy order was granted in June 2020 with Campbell Saunders Ltd. being appointed the insolvency trustee, the details of Quiqley's alleged fraud began to come into focus.

According to documents from the trustee, Quigley told investors their money would go towards buying up houses from elderly people getting ready to move into assisted living facilities.

The trustee claims none of this was true.

'The trustee has seen no evidence that [Quigley] purchased homes with the investment funds,' a November 2020 court document says, adding Quigley seemed to have had 'little or no source of funds' except for what his investors were willingly handing over.

'Based on the banking records received and reviewed by the trustee to date, funds received from investors were instead used in part to pay prior investors and in part to fund [Quigley] and his spouse's living and other expenses,' the trustee explained.

All in all, the trustee claimed Quigley owed 72 creditors over $26 million, larger than the estimate Edmonton Police have provided thus far.

Quigley spent years dodging the creditors, repeatedly telling the trustee the money was on the way, but somehow, it never came.

That's when the bankruptcy investigators shifted their focus to Treadgold, who ran a juice and raw food shop until it closed in the beginning of 2020.

A 2021 civil claim against her asserts that Quiqley was the chief operator of the Ponzi scheme, while she was either 'an active participant' or 'willfully blind' to the scam.

But an excerpt from a July 2021 court document would further expand on her alleged role convincing people to entrust their hard earned money to her husband.

'She encouraged people to "invest" by making representations … that [Quigley] was making friends rich by flipping properties, that only a small group of people were allowed to invest because it was doing so well, that she had sold her business because [Quigley] was making so much money,' the court document reads.

The truth was the opposite, as court filings show that two banks were coming after Treadgold in 2021 for allegedly falling into delinquency on her various lines of credit to the tune of $130,000.

Treadgold, who was going to be tried alongside Quigley in the trial set to begin in January 2025, has denied involvement in or knowing about any potential scam.

While there hundreds of alleged victims, only 80 people and businesses are listed as victims in the prosecution's case.

Read more 2024-07-02T14:35:21Z dg43tfdfdgfd